The Rise of Wind Power: Australia’s Wind Energy Boom

In the race to decarbonise the economy and secure energy independence, Australia has emerged as a renewable energy powerhouse—particularly in wind. Once seen as a supplementary energy source, wind power is now a cornerstone of Australia’s energy transition. Over the past five years, the industry has grown at an unprecedented rate, reshaping the national energy land scape, bolstering regional economies, and positioning Australia as a global leader in wind technology.

This blog explores the dynamic growth of Australia’s wind industry from 2020 to 2025, highlighting key trends, milestone projects, government policy impacts, and what the future holds for onshore and offshore wind development.

Rapid Capacity Expansion

Wind energy in Australia has experienced phenomenal growth, more than doubling in installed capacity over five years.

- In 2020, Australia had approximately 9.5 gigawatts (GW) of installed wind capacity

- By 2024, this figure increased to over 13.3 GW, with more than 100 wind farms operating across the country.

- The Australian Energy Market Operator (AEMO) reports that wind capacity has grown by an average of 13% per year.

This growth has been driven by declining costs, improved turbine efficiency, and the establishment of Renewable Energy Zones (REZs) that provide a coordinated approach to infrastructure planning. Wind is now second only to rooftop solar in terms of installed renewable capacity in the National Electricity Market (NEM), contributing significantly to meeting Australia’s climate targets and reducing reliance on fossil fuels.

Wind’s Rising Share in the Electricity Mix

Over the past five years, wind power has grown from a supportive renewable energy source to a foundational element of Australia’s electricity grid. It now contributes significantly to the National Electricity Market (NEM), supplying clean, low-emission energy to millions of homes and businesses.

National Growth in Wind Generation

Wind power’s share in the national electricity mix has increased consistently year on year:

- In 2019–2020, wind contributed around 8.5% of total electricity generation.

- By 2023, that share had increased to 12.7%.

- In 2024, wind generation surpassed 13.4% of Australia’s total electricity output, generating approximately 31.9 TWh.

- This sharp rise in output has coincided with a decline in coal-fired generation, reflecting both the ageing of thermal infrastructure and the economic competitiveness of wind.

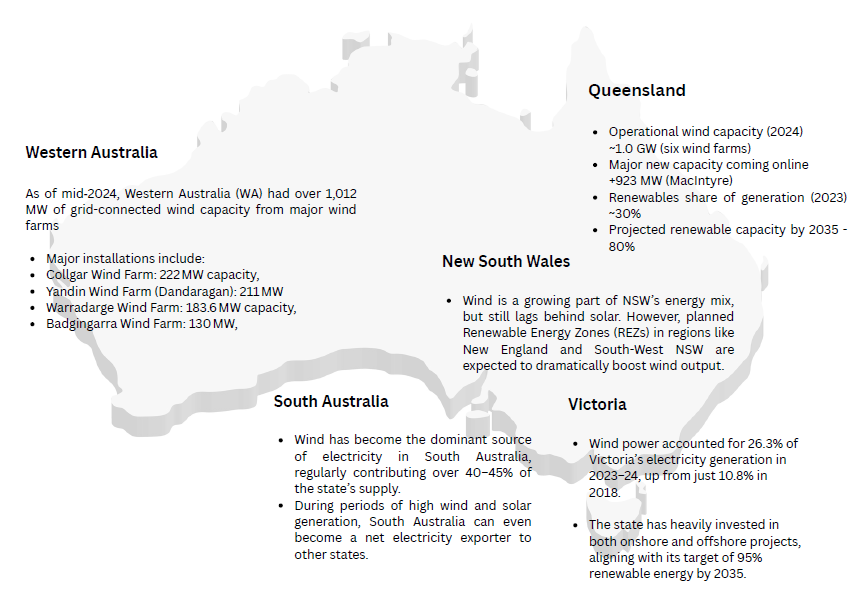

State-by-State Contributions

Australia’s wind power growth is not evenly distributed—some states are leading the charge, particularly those with strong policy frameworks and geographic advantages:

Flagship Projects Driving Scale

Several landmark projects have helped shape the wind sector’s expansion:

- Stockyard Hill Wind Farm (Victoria) – At 532 MW, it’s currently the largest in Australia, capable of powering 425,000 homes.

- Coopers Gap (Queensland) – Commissioned in 2020, this 453 MW farm remains a vital contributor to Queensland’s renewable energy target.

- Yandin Wind Farm (Western Australia) – Completed in 2021, this 211 MW project supplies clean power to over 200,000 homes.

- Golden Plains Wind Farm (Victoria) – With a planned 1.3 GW capacity, it’s expected to be the southern hemisphere’s largest wind farm when completed.

These projects are strategically located to take advantage of strong wind resources and proximity to transmission infrastructure. They also deliver considerable regional employment and investment, revitalising rural communities.

Record Investment and Government Support

From 2020 to 2024, investment in large-scale wind and solar projects surged:

- In 2024 alone, Australia recorded nearly A$9 billion in renewable investment, the highest level since 2018.

- The growth is underpinned by federal and state initiatives, including Renewable Energy Zones (REZs) in NSW, Victoria, and Queensland.

- The Capacity Investment Scheme (CIS) by the Australian Government, designed to underwrite clean energy projects.

- ARENA and CEFC funding support for grid integration and innovation.

Victoria, for example, has legislated targets for 95% renewable electricity by 2035, with wind expected to be a major contributor. The scale and consistency of investment have positioned wind as a reliable, scalable alternative to ageing coal plants.

Emerging Offshore Wind Developments

Although Australia’s wind sector has traditionally focused on onshore development, offshore wind is gaining traction.

In December 2022, the federal government declared the first offshore wind zone in Bass Strait off Gippsland, Victoria.

Victoria has committed to 2 GW of offshore wind capacity by 2032, scaling to 9 GW by 2040 – more than the entire current onshore wind fleet.

Additional offshore zones have been proposed for Hunter and Illawarra (NSW) and South Ocean (SA).

However, offshore wind faces unique challenges in Australia:

- High initial costs (up to AU$6 billion per project)

- Regulatory uncertainty

- Grid connection limitations

- Community opposition in some coastal areas

Still, the long-term outlook in promising. Offshore wind offers more consistent generation, ideal for balancing variable solar and onshore wind supply.

Economic and Environmental Impact

Wind power is one of the cheapest forms of new energy generation in Australia, with levelised costs of A$50–65 per MWh and falling.

Key benefits include:

- Emissions reduction – Projects like Golden Plains are expected to offset millions of tonnes of CO₂ annually.

- Job creation – Thousands of direct and indirect jobs in construction, operations, and maintenance.

- Regional development – Wind farms bring revenue to landowners, support local businesses, and improve infrastructure.

- Grid stability – Modern wind farms can provide synthetic inertia and frequency control.

Wind energy is now a central pillar of Australia’s decarbonisation strategy, playing a vital role in reducing coal dependency and meeting climate targets under the Paris Agreement.

What Lies Ahead: 2030 and Beyond

The Australian Energy Market Operator (AEMO) forecasts wind capacity could rise to 45 GW by 2030 and up to 174 GW by 2050—most of it linked to Renewable Energy Zones and hybrid (wind and storage) systems.

However, challenges remain:

- Transmission bottlenecks and delays in key projects like the VNI West interconnector

- Community engagement issues related to land access and visual impact

- Supply chain pressures, particularly for offshore components

Despite these hurdles, Australia’s commitment to achieving net zero emissions by 2050, combined with investor appetite and technological advancement, ensures wind will continue to power the nation’s clean energy revolution.